Getting The Pvm Accounting To Work

Getting The Pvm Accounting To Work

Blog Article

The Definitive Guide to Pvm Accounting

Table of ContentsPvm Accounting for BeginnersUnknown Facts About Pvm AccountingPvm Accounting for BeginnersGetting The Pvm Accounting To WorkThe Main Principles Of Pvm Accounting Pvm Accounting - Truths4 Easy Facts About Pvm Accounting DescribedEverything about Pvm Accounting

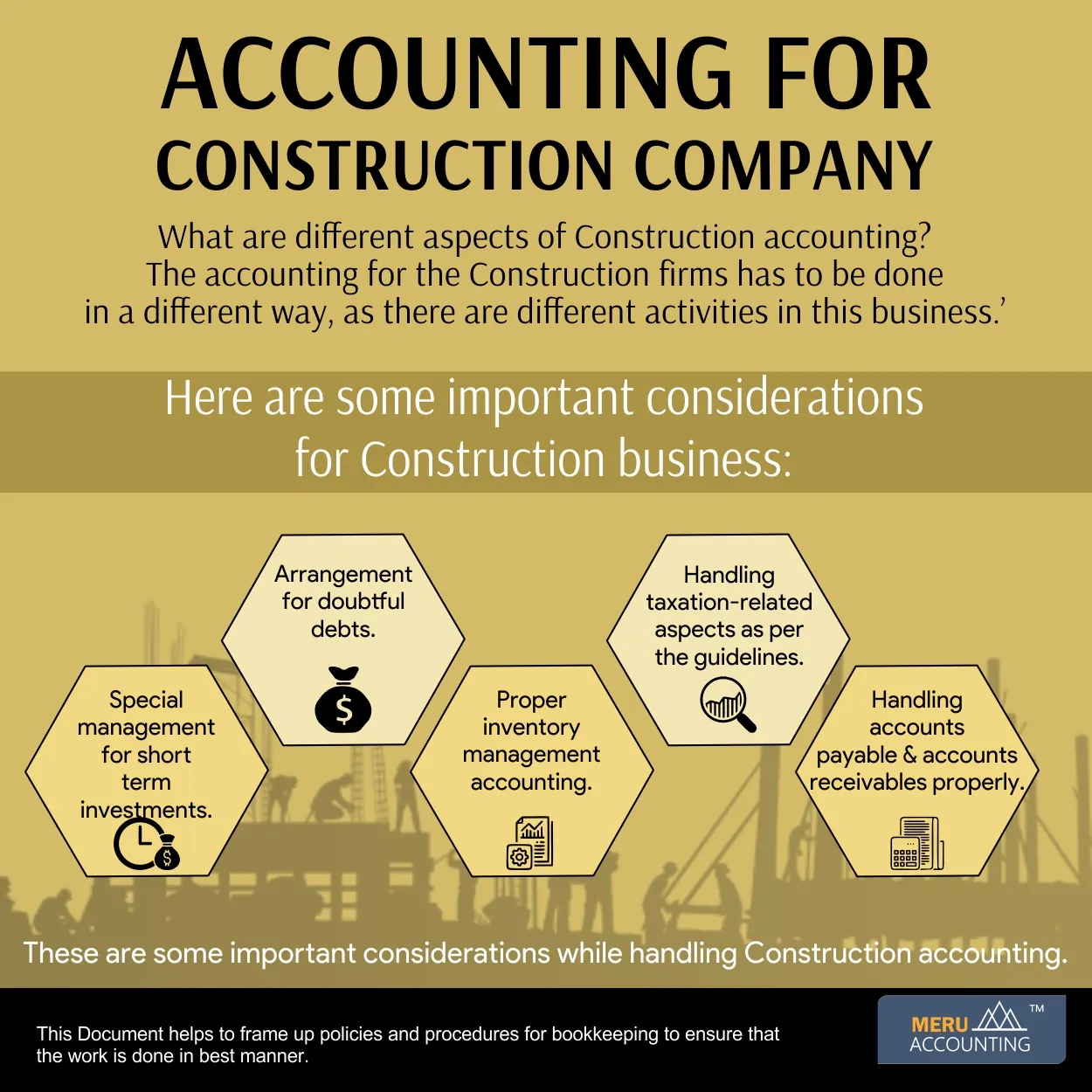

Among the primary factors for carrying out accountancy in building tasks is the need for financial control and management. Construction tasks typically require considerable investments in labor, products, devices, and other resources. Appropriate accountancy allows stakeholders to check and take care of these economic resources effectively. Audit systems give real-time understandings into job costs, profits, and profitability, making it possible for project managers to promptly recognize prospective concerns and take rehabilitative activities.

Building and construction projects are subject to various monetary requireds and reporting requirements. Correct audit makes certain that all economic deals are taped accurately and that the job conforms with bookkeeping standards and contractual contracts.

Some Known Incorrect Statements About Pvm Accounting

This minimizes waste and improves task efficiency. To much better recognize the relevance of accounting in construction, it's also important to distinguish in between building management audit and job administration bookkeeping. mostly focuses on the economic elements of the construction firm overall. It deals with general economic control, budgeting, capital monitoring, and economic reporting for the whole organization.

It focuses on the economic aspects of specific building tasks, such as expense estimation, expense control, budgeting, and money circulation management for a particular job. Both kinds of accountancy are vital, and they complement each other. Construction management bookkeeping makes sure the company's financial health and wellness, while project management accounting makes sure the financial success of private tasks.

Pvm Accounting Fundamentals Explained

A crucial thinker is required, that will deal with others to choose within their locations of obligation and to surpass the areas' job processes. The setting will certainly interact with state, university controller personnel, university department staff, and scholastic researchers. This individual is anticipated to be self-directed once the initial discovering contour relapses.

Some Known Questions About Pvm Accounting.

A Building Accountant is in charge of handling the monetary elements of building and construction projects, including budgeting, expense monitoring, monetary coverage, and conformity visit this site right here with regulatory requirements. They work very closely with task managers, service providers, and stakeholders to make certain exact financial records, expense controls, and prompt settlements. Their experience in building audit concepts, job setting you back, and economic evaluation is important for reliable economic administration within the construction sector.

Rumored Buzz on Pvm Accounting

Pay-roll tax obligations are tax obligations on a worker's gross wage. The revenues from payroll tax obligations are utilized to fund public programs; as such, the funds gathered go straight to those programs instead of the Internal Earnings Service (INTERNAL REVENUE SERVICE).

Keep in mind that there is an added 0.9% tax for high-income earnersmarried taxpayers who make over $250,000 or solitary taxpayers making over $200,000. Earnings from this tax obligation go towards government and state unemployment funds to help workers who have actually shed their tasks.

9 Easy Facts About Pvm Accounting Described

Your down payments should be made either on a regular monthly or semi-weekly schedulean election you make prior to each calendar year (Clean-up bookkeeping). Month-to-month payments - https://pubhtml5.com/homepage/ijerc/. A regular monthly payment must be made by the 15th of the following month.

Take care of your obligationsand your employeesby making total pay-roll tax settlements on time. Collection and settlement aren't your only tax obligation duties.

7 Easy Facts About Pvm Accounting Described

States have their own pay-roll tax obligations. Every state has its very own unemployment tax (called SUTA or UI). This tax rate can differ not just by state yet within each state. This is due to the fact that your business's market, years in business and joblessness background can all identify the percentage used to determine the quantity due.

Pvm Accounting Fundamentals Explained

The collection, remittance and reporting of state and local-level taxes depend on the federal governments that levy the tax obligations. Plainly, the subject of pay-roll taxes entails plenty of moving components and covers a wide variety of accountancy knowledge.

This web site makes use of cookies to improve your experience while you browse with the website. Out of these cookies, the cookies that are categorized as needed are kept on your web browser as they are necessary for the working of standard functionalities of the internet site. We additionally utilize third-party cookies that help us examine and recognize exactly how you use this website.

Report this page